Banking and Fintech

State-of-the-art solutions require state-of-the-art implementation expertise – Adnovum ensured a seamless transition to the new CIAM at SIX

Read the story

Banking and Fintech

Through the expert implementation of Adnovum, Cornèr Banca gains the full benefit of the Nevis Security Suite

Read the story

Banking and FinTech

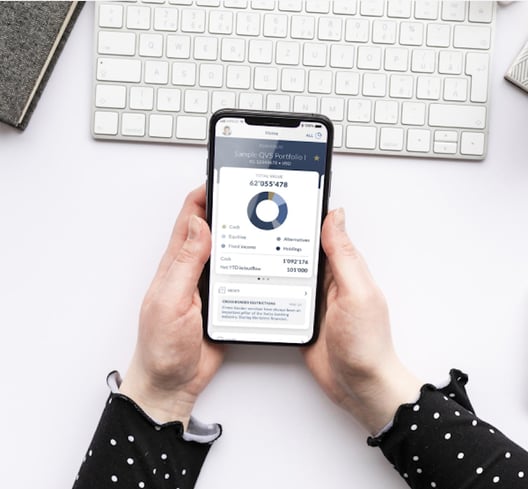

Making wealth management and banking as easy, but also as safe as possible for entrepreneurs and families

Read the story

Banking and FinTech

When stakeholders demand the highest IT security standards for managing new financial assets, Adnovum is the service provider of choice

Read the story

Banking and FinTech

Adnovum provided the eGov Secure Collaboration Suite, which secures the flow of information, streamlines processes, and addresses cybersecurity risks

Read the story

Banking and FinTech

The tailor-made asset management software is based on a proprietary infrastructure with multi-signature policies and hardware security modules

Read the story

Banking and FinTech

With an environment-friendly solution that drastically simplifies the authentication process and furthermore reduces support and equipment costs

Read the story

Banking and FinTech

FiRA’s performance and appearance receive a boost with a cloud-enabled backend and a visually and functionally improved user interface

Read the story

Banking and FinTech