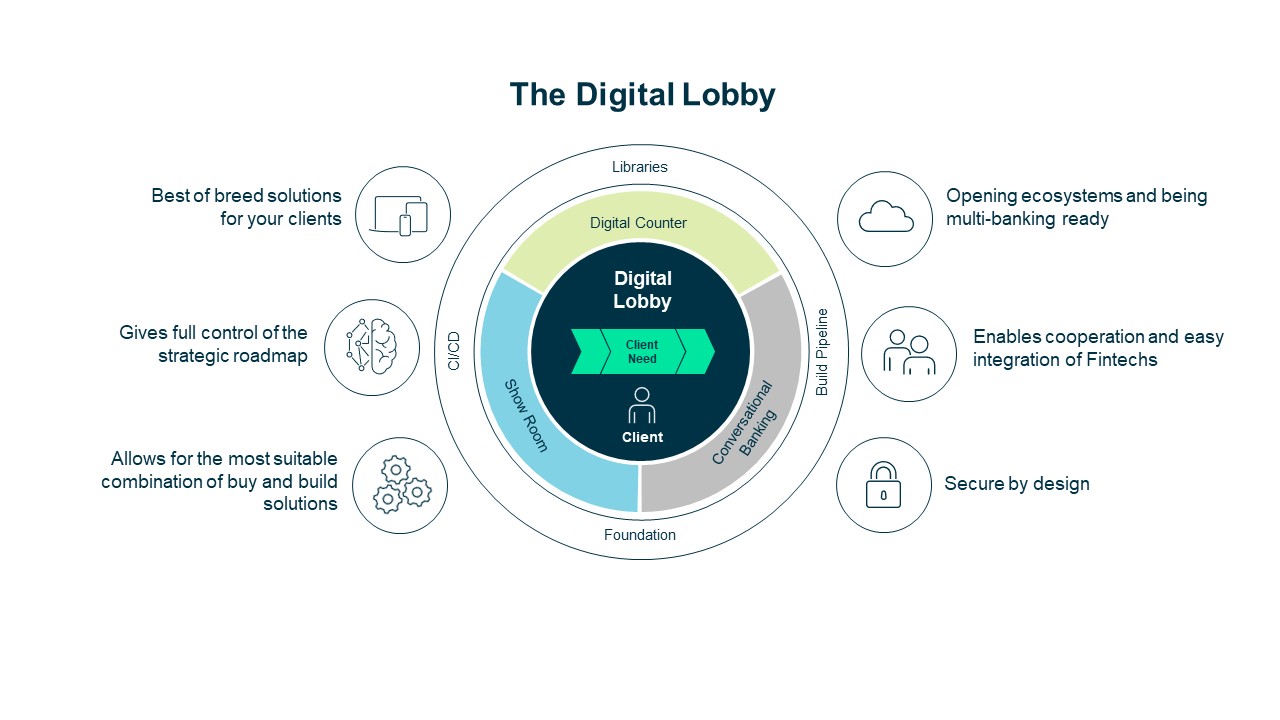

A mobile banking offering is more than a «must have» these days. It is quickly becoming your main and only engagement point with your customers. «Mobile first» – what has started as a fancy of the neo-banks to cut cost and implement efficient processes – is nowadays how customers expect your bank to deliver services. With that, being distinct in your online appearance is no longer an option, it is a must. Extend the care you give to your reception halls to your digital lobby. Build the digital twin of your business.

The decisive factor for keeping customers engaged is the something extra, special, i.e., «features» in the app and with which the bank can differentiate itself from its competitors. Whether it is to leverage the opportunities of open or multi-banking, integrate a FinTech or two or participate in the increasing number of ecosystems and cooperations in and outside the financial industry.

In the fast-paced digital world, it is therefore crucial that financial service providers continue to be perceived with their quality of service and their USP, and that these are reflected in their digital mobile offering.

How to shift from monolithic to mobile first

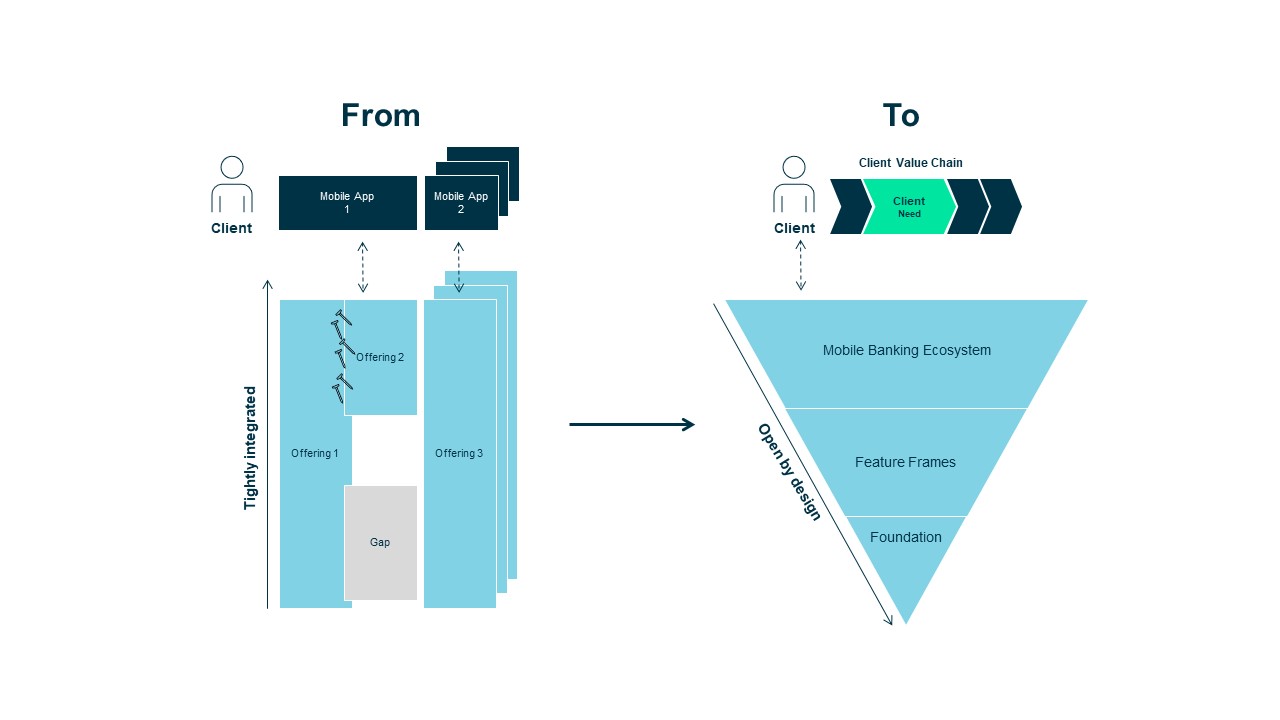

Being tied up and locked in with a monolithic off-the-shelf solution or the default core banking offering can slow your time-to-market down to a crawl. New and exciting features do take too long to get into the hands of your customers. In addition, you depend on the vendor’s pace and strategic outlook, meaning what will be delivered next is decided outside of your organization.

Taking back control, financial institutions are therefore increasingly facing challenges from the world of software development – in particular the balancing act between what to buy and what to build. Adding the complexity of how to integrate the whole thing into a consistent top-notch user experience. How to address this challenge?

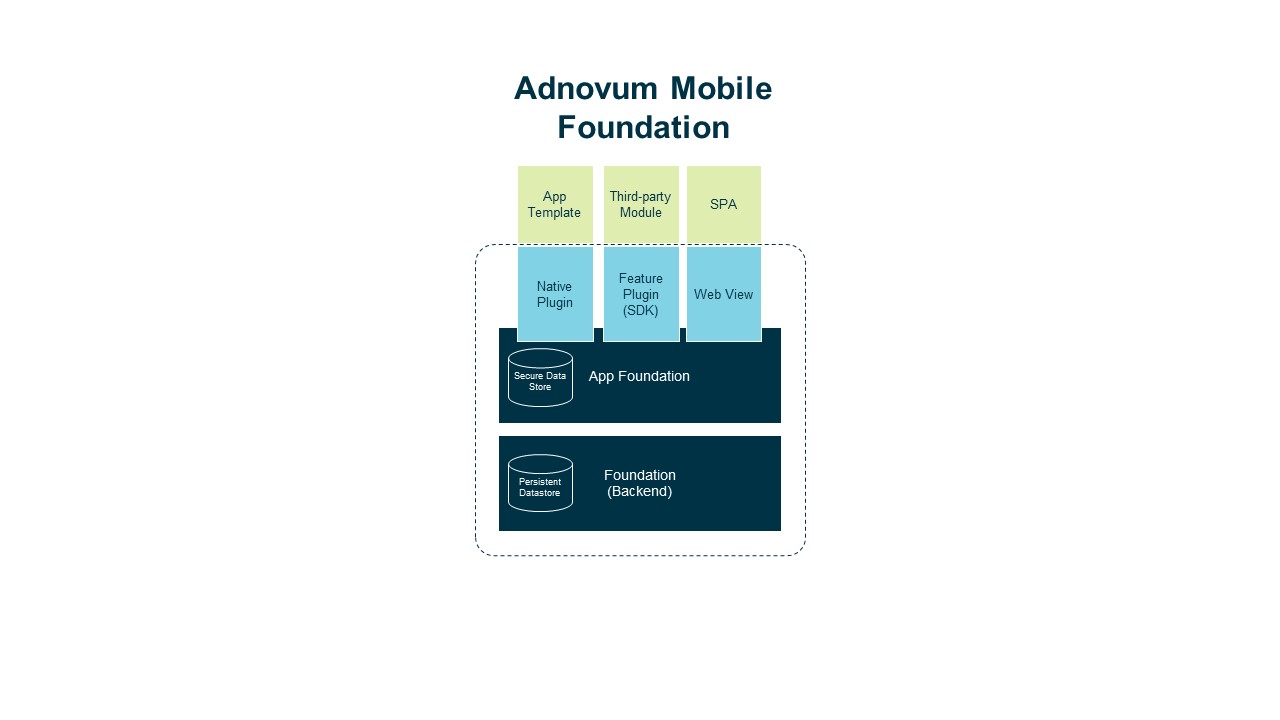

The key is to bring the right people with the right DevOps processes and the right technology stack together. Based on 30+ years of experience and numerous mobile applications, Adnovum is building a new mobile banking foundation. Created on an «open and secure by design» approach, it provides you with the flexibility to select, build and integrate the mobile banking solution you need. Whether you plan to reuse some of your existing single-page applications, integrate a FinTech via SDK or leverage native features, state-of-the-art mobile banking is your direct connection to your customers.

The key is to bring the right people with the right DevOps processes and the right technology stack together. Based on 30+ years of experience and numerous mobile applications, Adnovum is building a new mobile banking foundation. Created on an «open and secure by design» approach, it provides you with the flexibility to select, build and integrate the mobile banking solution you need. Whether you plan to reuse some of your existing single-page applications, integrate a FinTech via SDK or leverage native features, state-of-the-art mobile banking is your direct connection to your customers.