Partner ecosystems are considered to be the best approach to respond quickly to changes in the market, as they allow fintechs and partners to jointly develop technology and product innovations.

Driven by network philosophy, an independent and easy-to-maintain collaboration platform provides a solid basis for exchange between the bank, fintechs and partners. Banks can thus benefit from external expertise and test new ideas and develop agile solutions in close cooperation with their partners. This not only increases competitiveness, but also optimizes operating costs and helps to meet customer needs in a targeted manner.

What are the types of partner ecosystems?

The partner ecosystem takes different forms. In addition to the classic collaboration form of giving partners access to your own systems, these are the three most important ones:

-

Co-engineering platform for banks

A co-engineering platform enables banks to test new ideas and features. They can either try out new approaches in the lab or expand existing solutions by integrating merger technologies or fintech solutions. The platform provides a shared and secure development environment in which partners can design and integrate business solutions. -

Innovation platform for fintechs

An innovation platform offers fintechs the necessary tools and access to an established partner ecosystem to realize their ideas. These ideas can be tested with dummy data in a sandbox environment – from ideation to verification. For a smooth process, synthetic test data is required. Fintechs are integrated directly into the collaboration environment and pay for access. Similar to a FabLab, the platform provides access to state-of-the-art production and development engineering as well as an environment for tinkering and sharing knowledge. -

Neutral collab zone for technical due diligence

When onboarding new products and partners (possibly through M&A activities), it is advisable to carry out technical due diligence in order to assess compatibility in the operational environment. A partner ecosystem enables the setting up of a neutral collaboration zone in which banks can thoroughly test the system integration. After all, technical dependencies play a decisive role in the success or failure of the integration.

What all three have in common is their independence from the restrictive environments of today's banking platforms. Separating the collaboration zone creates freedom and flexibility for creativity. In addition, it promotes compliance and data protection.

Advantage and creation of a partner ecosystem

Whether working with fintechs, integrating new products and partners, or developing innovative services and agile projects: A collaboration platform (also known as a creative lab) enables a fast and cost-efficient approach.

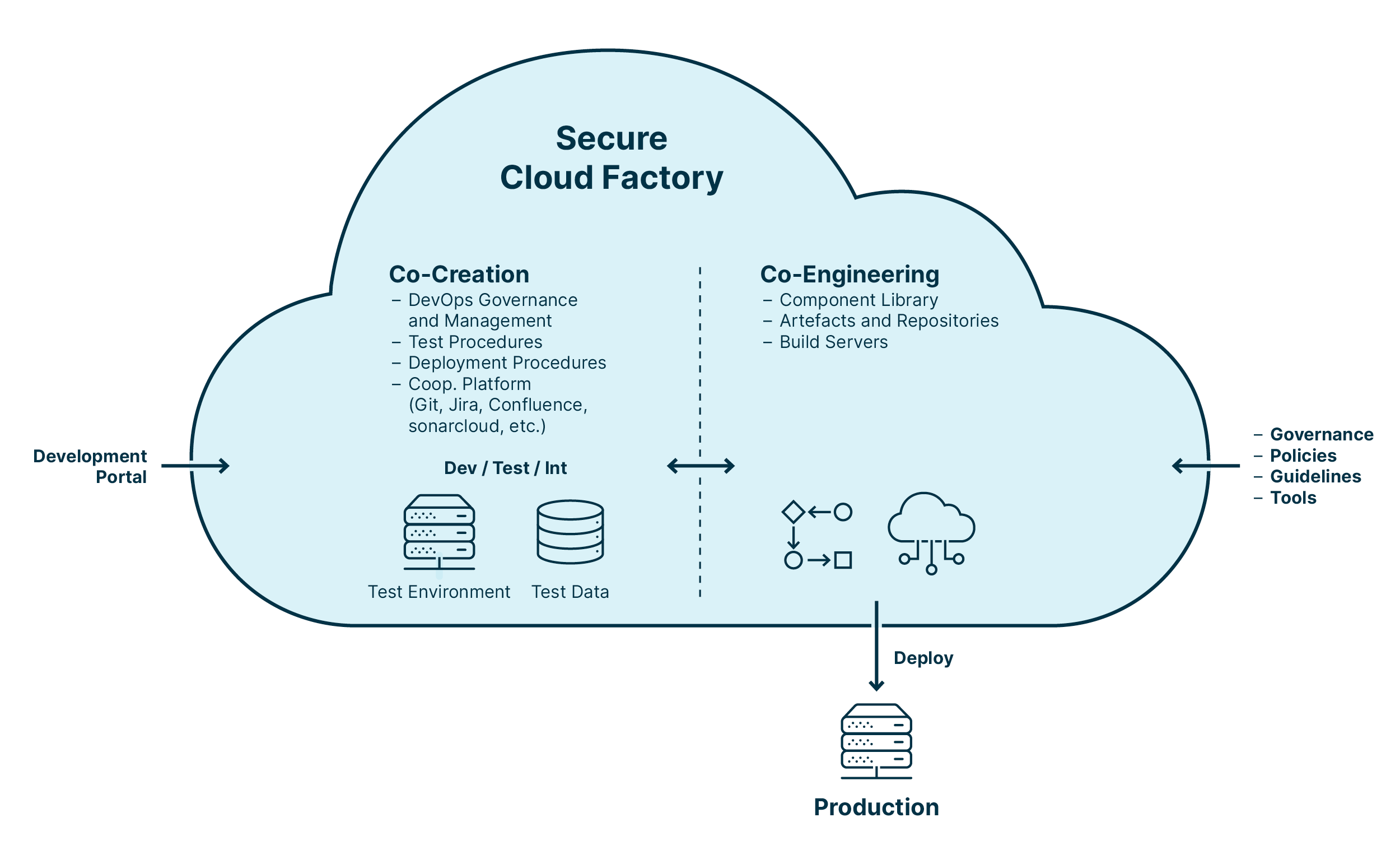

A successful collaboration platform consists of two components: a co-creation area and a co-engineering area. The co-creation area serves to define DevOps processes as well as development and test methods. The co-engineering area provides all the necessary components, libraries, and artifacts.

If providers use a common platform and exploit synergies, they have a real chance of providing their customers with the desired offers quickly and staying ahead of the competition.