The challenge

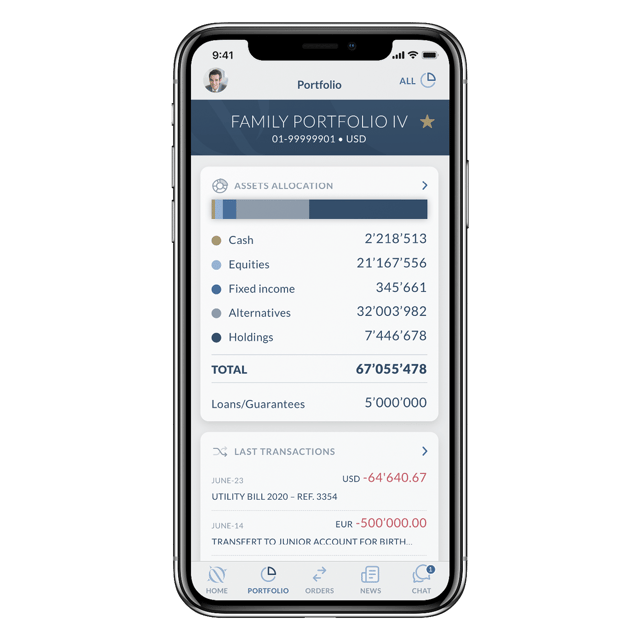

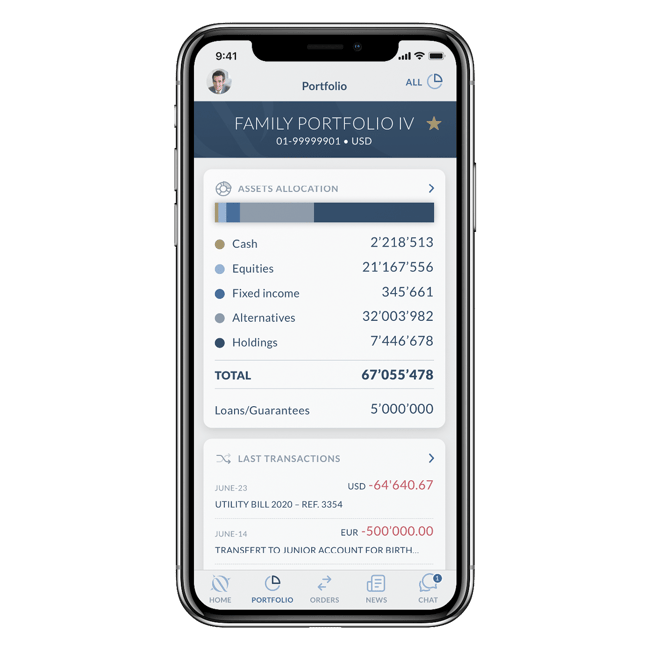

Even the most established financial service providers need to adapt to changing customer habits. Quilvest’s younger customers are particularly keen to use WhatsApp to communicate with investment advisors and manage their banking transactions without unnecessary complications. However, this is not a viable long-term solution as legally binding bank transactions cannot be settled via messaging apps.

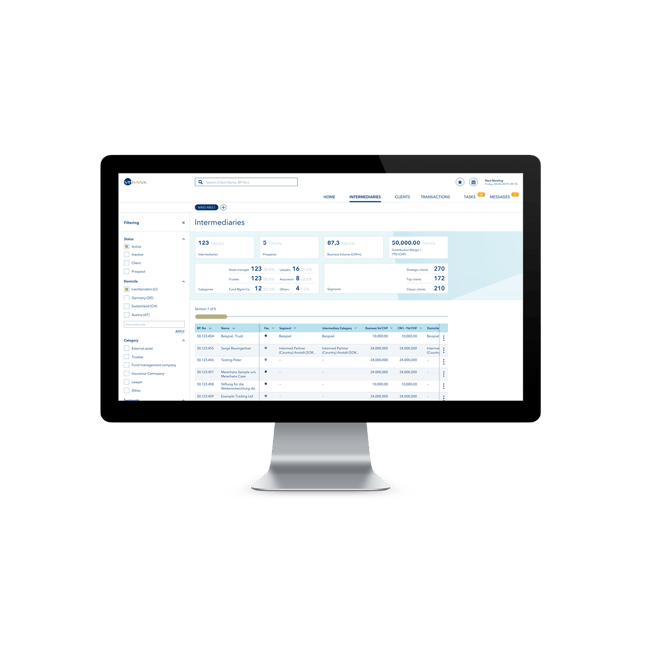

Quilvest wants to offer its customers maximum convenience but within a framework that satisfies both data security and confidentiality requirements. With this in mind, Quilvest developed a platform which includes secure communication via chat. Together with this, a new authentication solution backed by a firewall for setting up e-banking was required.

We were thrilled to be selected as a provider of choice to develop the AccessApp – but this wasn’t the start of our business relationship with Quilvest. Together, we have been working on several security consulting and software development projects since 2016, such as their website relaunch. To develop the new authentication solution, we teamed up with our partner Nevis.