The goal: To take the KeyClub application to a new level of technology, with a strong focus on improved stability and usability, as well as increased agility to reduce expenditures and the time to market for new promotions and features.

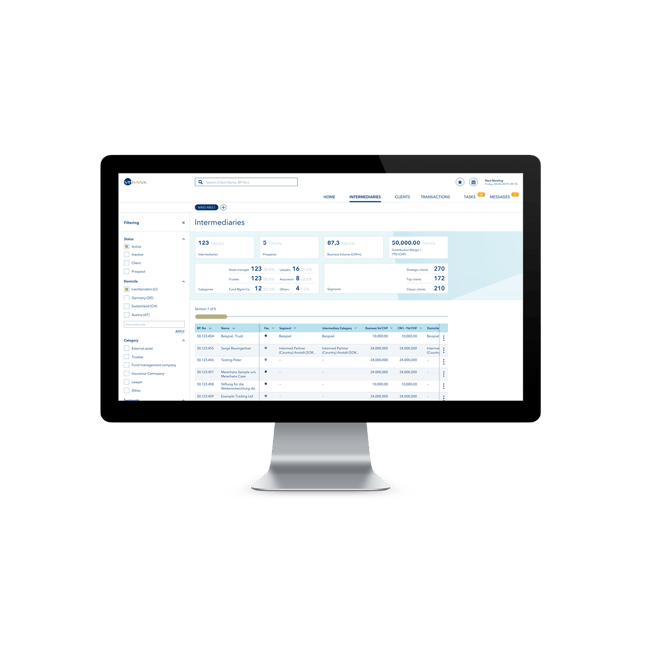

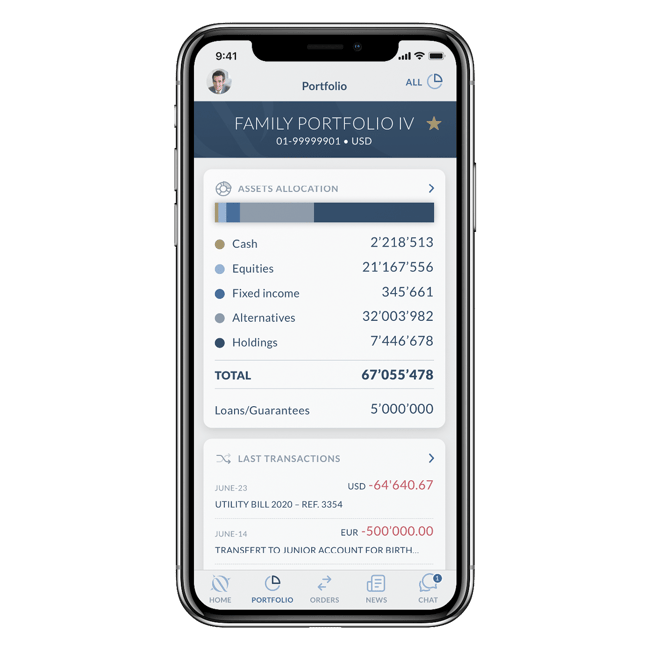

The process: In a close collaboration between UBS and Adnovum, the new KeyClub application was designed, specified and engineered according to a modular approach. This was implemented by allotting the numerous business rules that govern the calculation of bonus points to individual modules, which in turn were outsourced to a business rule engine and integrated with the data warehouse by means of data marts. Interfaces with the mainframe services and other surrounding systems were created to improve access to various functionalities including the external card provider and KeyClub eShop. In keeping with the technological upgrade, we have also given KeyClub a new state-of-the-art GUI. The smooth operation of the application is ensured by the continuous maintenance and support provided by Adnovum.

The result: A stable and user-friendly application with quicker processes and shorter response times that provides customers with numerous features to manage their goodwill points. Administrators and marketing also profit from the new setup while administrating members and participating partners, as well as monitoring and evaluating client transactions and points calculation. Thanks to the modular setup, changes to individual business rules affect only the smallest possible software component, which enables an easy and swift implementation. Specifications, regression testing, and new releases of the overall system no longer require additional effort. In addition to the improved previous functionalities, new services and features can be introduced independently from the company’s release schedule. UBS KeyClub boasts a report engine for more than 1,2 million member accounts and approximately 5’000 UBS users across Switzerland.