The IT asset management software market is projected to grow by a significant USD 456.14 million (CAGR 7.58%) between 2023 and 20281. The market's growth rate is determined by several variables, such as the quick uptake of asset management software and the increasing significance of asset tracking, the growing requirement to comply with industry standards, and the development of IT infrastructure.

As regulations continue to evolve and expand, coupled with the exponential growth of assets within modern enterprises, the need for robust IT governance and compliance solutions that are integrated with asset management systems becomes an important strategy. These unified solutions can help organizations improve compliance visibility and mitigate risks more effectively.

Siloed Approaches: A Barrier to Compliance Excellence

Traditionally, organizations have adopted a siloed approach to asset management in IT governance, wherein various departments operate independently, utilizing disparate systems and processes. This fragmented landscape leads to inefficiencies, with each department maintaining its own set of records and methodologies. Consequently, the lack of cohesion across these silos results in a fragmented view of assets, making it challenging to maintain accurate and complete information for compliance and risk management purposes.

The limitations of such disjointed practices are glaring. Data inconsistencies, gaps in visibility, and increased vulnerability to non-compliance and security risks are just a few of the issues organizations encounter. Without a unified asset management strategy, organizations struggle to effectively track, monitor, and safeguard their assets, leaving them exposed to potential compliance violations and security breaches.

The Power of Asset Management Integration

Integrating compliance with asset management systems signals a paradigm shift in how organizations approach compliance and risk management. It involves consolidating disparate asset management systems into a unified framework that seamlessly integrates with IT governance software and compliance solutions.

This integration unlocks numerous benefits, including:

- Enhanced asset inventory visibility

- Streamlined compliance processes

- Improved risk mitigation capabilities

Poor IT asset management leads to heightened security risks and non-compliance. A 2022 KPMG report revealed that large companies paid an average of $80 million in non-compliance fines2. Investing in compliance management software integrated with asset management systems is crucial to mitigate security risks and avoid hefty fines.

Learn more: Conquer Compliance with The Continuous Path to IT Governance Excellence

Implementing Integration: A Practical Roadmap

Embarking on the journey towards asset management integration requires careful planning and execution. A practical roadmap for integration involves several key steps:

- Assessment and Planning: Conduct a comprehensive assessment of existing asset management systems and processes. Identify inefficiencies and define integration needs based on compliance and risk management.

- Selecting the Right Technology Partners: Collaborate with reputable technology partners specializing in IT governance and compliance solutions. Choose vendors with a proven track record of delivering integrated asset management solutions tailored to organizational requirements.

- Integration and Deployment: Implement integration in phases, prioritizing critical assets and compliance goals. Utilize automation tools and standardized protocols for seamless data exchange across systems.

- Monitoring and Evaluation: Continuously monitor the performance of integrated asset management solutions, leveraging analytics and reporting functionalities to track compliance metrics and identify areas for improvement. Regularly assess the effectiveness of integration initiatives against predefined success criteria.

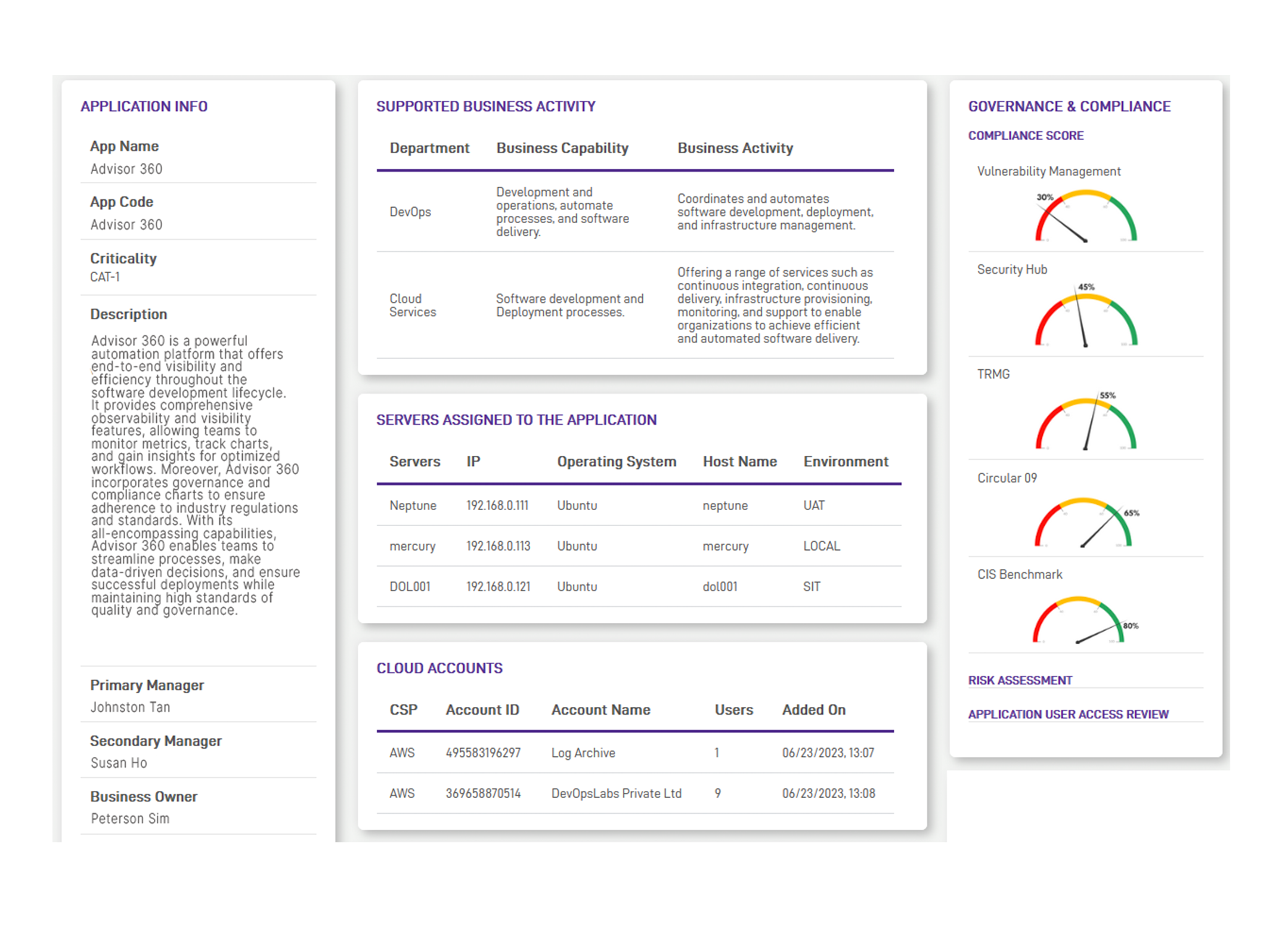

Advisor 360: A Solution in Action

- Enhanced Asset View: Our approach goes beyond simply identifying assets. We also consider associated licenses, departmental and divisional structures, users with their access levels and hierarchies, and a vertical perspective from the application standpoint. This provides a more comprehensive view than the traditional view offered by the Configuration Management Databases (CMDBs).

- Hybrid Assets: With most applications moving towards commercial or private commercial cloud, it is important to look at assets on premise as well as on cloud.

- Automated and Connected Processes: Break down silos and simplify compliance processes by automating tasks and fostering better collaboration. Gain a comprehensive overview of compliance on your IT assets. Spend more time to take corrective action instead of wasting effort on extracting manual reports for compliance.

Integrating asset management into IT governance and compliance solutions is a strategic move for organizations seeking to elevate compliance visibility and mitigate security risks. By breaking down silos, consolidating systems, and fostering collaboration, organizations can achieve compliance excellence and safeguard assets in a dynamic regulatory landscape.

Contact Adnovum’s team of governance and compliance experts today to embrace the power of asset integration within an automated and connected compliance management software.

Reference:

2. KPMG. (2022). A triple threat across the Americas: 2022 KPMG Fraud Outlook.